When it comes to exports and imports, it is very important to learn about the payment system. There are various international payment systems you can customize as per the need. L/C or Letter of Credit is one of the payment systems that you can consider if you want to import or export to Indonesia. Here we are going to discuss about what is a L/C and its advantages

What is a Letter of Credit ?

Generally, Letter of Credit is a debt instrument that links an importer and an exporter. Through this letter, the importer tries to process the payment meant for the exporter after fulfilling all the requirements in L/C. It is a settlement letter issued by the bank. This is one of the recommended international payment systems in the export and import process, especially in Indonesia.

In addition of that, it also serves to guarantee the execution of payments between importers and exporters.

Advantages of Letter of Credit

The advantages of a letter of credit for exporters and importers are, in particular:

1. Security of Payment and Avoidance of Risk.

Even if the exporter does not know the importer, a L/C can serve as a guarantee for the exporter that the bank will pay the invoice as prescribed.

2. Avoid the Risk of Foreign Exchange Transfer Restrictions

Foreign exchange banks in the importing country are already aware of foreign exchange transfer restrictions and can open a letter of credit if an importer meet all regulations by the government. The bank has foreign currency prepared for each receivable based on the letter of credit. In this way, exporters avoid the risk of non-payment that may occur.

3. Documents Can be Submitted Immediately

When you ship the goods, an advising bank can negotiate the exporter the L/C immediately. Therefore, there is no need to wait for payments or remittances from the importer . Conversely, if there is no letter of credit, it is impossible for the exporter to negotiate. After that, he must wait for a remittance or transfer of funds from the importer.

4. Guarantee of the Documents.

Importer will receive the documents of the goods completely because it is verified by a bank that has expertise in this area. In addition, importers may impose conditions for security arrangements that the exporter must meet in any case in order to withdraw money from L/C.

5. Increasing The Exporter's confidence in The Importer.

Opening a letter of credit means that the opening bank lends its good name and reputation to the importer so that the exporter can trust it. The exporter has the assurance that importer will pay the shipment of the goods no matter what.

Types of Letter of Credit

In addition to the definition and advantages, you also need to understand the types of it. The types of L/C are determined by their function, such as :

1. Clean Letter of Credit

This type of L/C can be a type that is quite simple and straightforward. A party can make money withdrawals based on a bank credit without having to meet other requirements.

2. Irrevocable Letter of Credit

With this type of L/C, the cancelation is only possible if the beneficiary or exporter receives confirmation.

3. Revocable Letter of Credit

This type of L/C allows for the cancellation of transactions between importers and exporters without requiring authorization and confirmation from the beneficiary or exporter.

4. Confirmed and Irrevocable Letter of Credit

This fully guarantees the repayment activity and payment process.

5. Documentary Credit

This type requires the parties wishing to make a disbursement or process the letter of credit to complete all the required documents listed in the terms and conditions of the L/C.

6. Revolving Letter of Credit

Unlike the documentary type, revolving type does not require the user to attach any other documents that are required for withdrawals or credit. The party can use it again in the future without having to fulfill various documents again. Credits can also be granted for a specific period of time, which is more flexible than other types.

7. Documentary L/C through Red Caluse

This is a combination of the documentary type and also the open one. This provides the right to process payments that can be made through the method of draft withdrawal without collecting the various required documents.

8. Back-to-Back Letter of Credit

This generally acts only as an intermediary between the importer and exporter unlike other L/Cs.

Parties Involved in Issuing Letter of Credit

In issuing a L/C for export import activities, there are several parties who have roles and their respective functions such as :

1. Applicant (buyer, importer, account holder, consignee)

This is the party requesting the bank to open aL/C on its behalf, and the applicant’s position in an international trade transaction as a buyer.

2. Beneficiary (seller, exporter, consignor, vendor)

This is the party to whom the letter of credit is issued or who receives the L/C. Beneficiary position in international commercial transactions as seller.

3. The Exchanging Bank

This is a bank that opens or issues a L/C at the request of the applicant. The L/C opened by the opening bank on the basis of the application for the opening of a L/C submitted by the applicant must be a foreign exchange bank.

4. The Correspondent Bank

This is a bank that forwards the letter of credit received from the opening bank to the beneficiary (seller). The opening bank opens a L/C for the exporter through another bank in the exporting country, which corresponds with the opening bank.

5. The Negotiating Bank

This is the bank that conducts the purchase or negotiation of a bill or draft and the seller’s shipping documents. Usually, an advising bank is also a negotiating bank. The purpose of the negotiation conducted by the advising bank is to make payments to the beneficiary, and thus become the legal holder of the assumed documents.

6. Reimbursing Bank

This is a bank that makes reimbursements to the negotiating bank for the redeemed letter of credit.

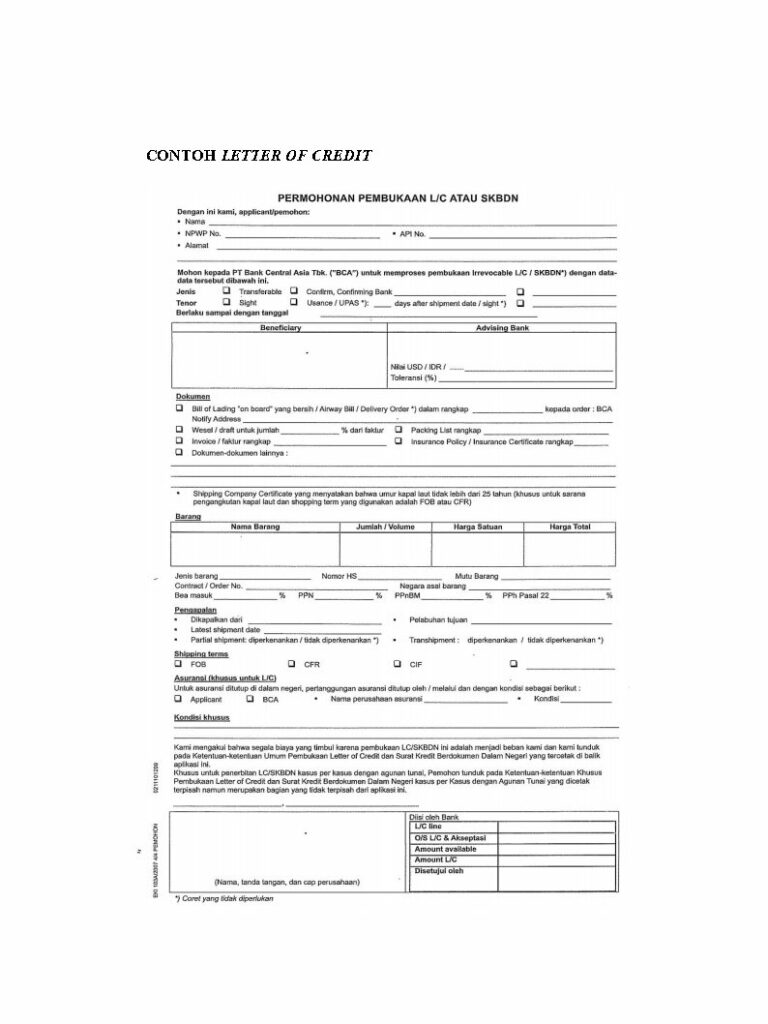

How to Submit a Letter of Credit ?

Below are some procedures to do submit a Letter of Credit to make your import activities easier.

First, an importer asks one of the designated foreign exchange banks in his country to issue the L/C on behalf of the exporter.

After that, the bank makes sure that the importer has fulfilled all the requirements for an importer, such as an import license. Only then does the bank open a L/C in the name of the importer.

L/C is opened in the name of the importer at the overseas correspondent bank. The correspondent bank is an intermediary or advisory bank.

Thereafter, the bank informs the exporter about the L/C opening process on his behalf. Here the exporter can be designated as the beneficiary.

Once the exporter has received the L/C, the exporter has to take the goods to the forwarder who will exchange it for a bill. This bill serves as a transaction proof for the exporter to receive a sum of money from the importer.

Thereafter, the B/L is given to the importer by the concerned bank so that he can present it to the carrier to receive the goods purchased.

In order to examine the most suitable payment instrument and trustworthy bank, both importer and exporter must have good communication to avoid misunderstanding. If you do not have any trusted information about that matters, you can contact us to help you. You can also Sign Up to our platform directly to get easy access of import export platform.